Before we start, I just want to thank you all (again!) because guess what?

Brooklyn Family Travelers is on the TOP 40 LIST of BESTSELLER Substacks in Travel!!

I am so thrilled and honored (and shocked tbh!). It really means so much to me to know so many people are here and reading.

Thank you :)

I’ve gotten a lot of messages over the last few days asking about the new 100k card offer which is great (always happy to answer messages!).

One of the common ways this often plays out goes a little like this:

Me: Do you have this card already?

Them: Yes we have it!

Me: Ok you might still be eligible

Them: How??

Me: So, one of you is actually the main card holder and the other is the authorized user. Do you know which is which?

Member: Oh — I thought it was a joint account!

So, let’s discuss!

There is actually no “we” in credit card land. You are you, your partner is your partner and you both come to the banks with your own credit scores, bank history etc.

When you apply for a card, there will not be an option to apply as a couple. You apply as card holder and can add authorized users. This means that only one of you actually “has” the card according to the bank.

But it’s not just about semantics. Understanding this can help you earn significantly more points. Let’s call you each a player in this fun game of earning points.

How to get a second welcome bonus when you already have the card

Note: Player 1 = P1 and Player 2 (your partner or friend) = P2.

Scenario 1:

You (P1) apply for a card

You get the welcome bonus after spending x amount of money (yay for points!)

You add your P2 as an authorized user

Your fam gets ONE welcome bonus

Scenario 2:

You (P1) apply for a card

You get the welcome bonus after spending x amount of money

P2 applies for the same card

P2 gets the welcome bonus after spending x amount of money

Now, your family has earned TWO welcome bonuses!! Huge difference.

This is helpful and timely because you may be seeing the posts about this 100k card offer and feel it doesn’t apply to you because you already have the card. But wait!

Here’s how to get the bonus when you already have the card:

You’re eligible for this card’s bonus, every 4 years. Did you get this card around early COVID times or before? You’re likely eligible for the bonus again! See details here.

If you thought you had a “joint” account, actually one of you is the primary and the other the authorized user. Whoever is not the primary, can apply for their own card here (click “our favorite cards” and it’s the FIRST card in that link).

Note: if you feel “allergic” to having two cards because it means two annual fees, look at it this way:

Welcome bonus = $2000+

Annual fee = $95

After one year, you can downgrade one of the accounts to a free card! This way, it doesn’t change your credit score and you won’t have to pay a $95 fee in perpetuity.

Downgrade and reapply

If you’ve had the card more than 4 years, there’s also the option to downgrade and reapply. Here are the steps!

Call the bank at the number on the back of your card and ask if you can downgrade your to the card with no annual fee that earns points. If they are not sure which card you’re referring to, never be afraid to hang up and call again to speak with a different representative. This is a card you can only get through a downgrade (message me for the card name —- affiliate rules!)

If you downgrade your card, you will not lose your credit history or credit limit so it will not impact your credit score like it will if you close your card.

After two weeks or until after the statement closes, you can refer to this post and apply again by clicking here, then “our favorite cards” and going to the FIRST card in that link to snag this 100K offer! Thanks as always for using my links!

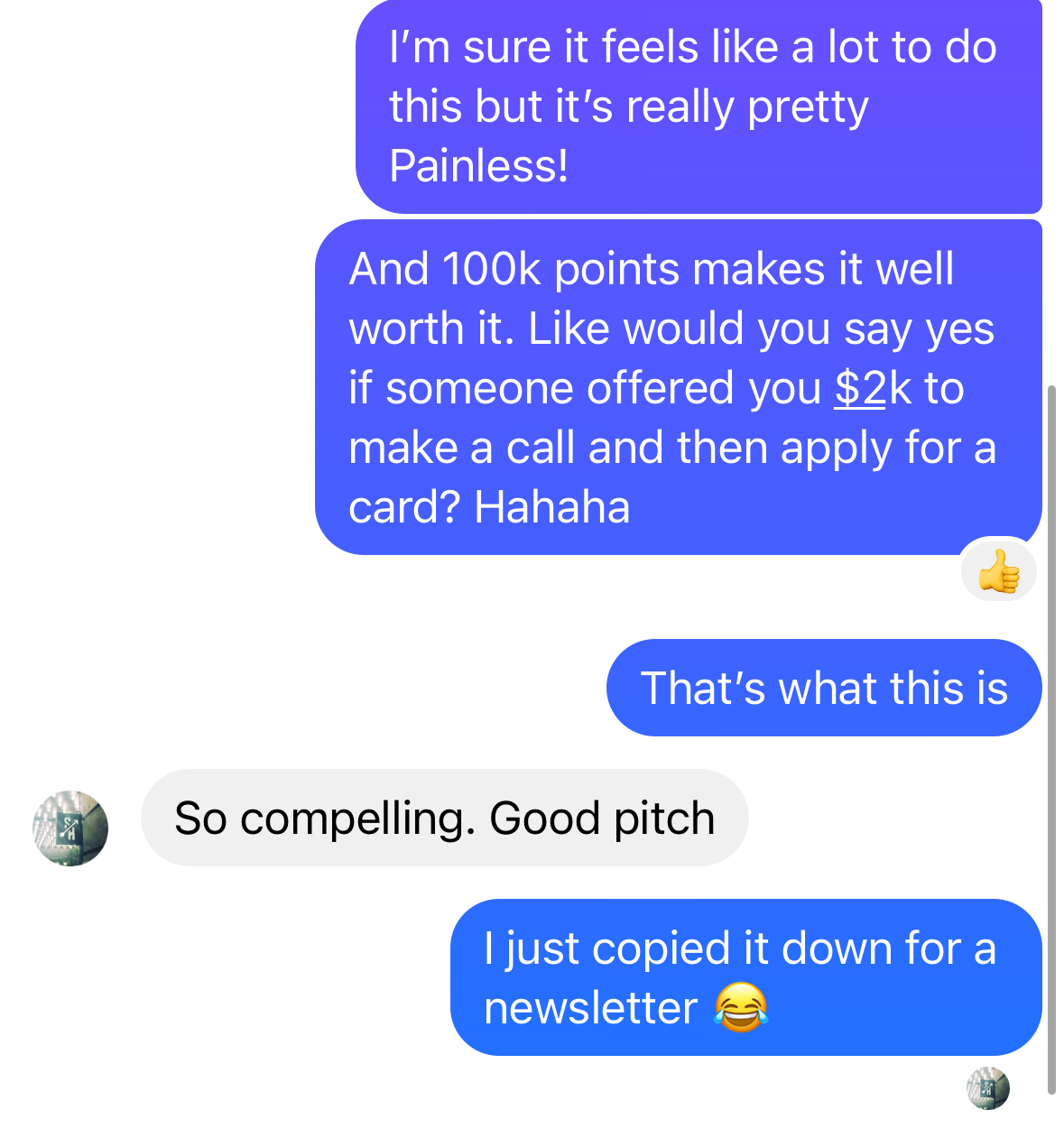

To sum it up, here’s what I said in a message to someone earlier this week re: the downgrade and reapply option after four years:

Credit score concerns

Concerned about your credit score? I get it! You absolutely should always be thinking about that IMHO! Here’s a post about credit scores including a cute baby picture of yours truly on my favorite toy horse, Blaze.

Hint: in short, more credit cards should raise your score, not lower it!

How to apply

If you’re ready to get this card (sorry to sound cagey - affiliate rules prevent me from mentioning actual card names in emails!!) just click here, press “our favorite cards” and it’s the FIRST card. Want a link sent right to you? PM me or simply reply to this email! Remember that using my links is an easy way to support Brooklyn Family Travelers. Here’s a little Thank you note I wrote about that :)

Some helpful posts you may have missed:

Want to know which cards I carry around? Which points have the highest value (may not be what you think!) or the best hotel brand for booking points stays (again - may surprise you!):