I grew up in the quiet suburbs of metro Detroit, the child of two public school educators who were very cautious about money and credit. They added me to their accounts as an authorized user at a young age to build my credit, and taught me how important it is to pay credit cards off in full every month — and to not spend beyond my means.

I internalized this. My credit score is 820ish and I would never want to do anything to jeopardize the good credit I’ve been building all my life.

The foundation of traveling with points is to (very strategically!) take advantage of welcome bonuses on cards. That means opening a new card, shifting spending to that card until reaching the minimum spend, and then going for another card (again, strategically!).

Look at these two scenarios:

You spend $4k in the next 3 months on a card you already have, you’ll earn about 4k points.

You put that same $4k on a new card that earns a welcome bonus of 60k points in 3 months (on top of the regular points). You now earn at least 64k points on that same $4k spend.

In the second scenario, the number of points you’re getting from each dollar you spend is 16x! That’s a giant multiplier (eg: 3x groceries, 4x restaurants, etc) that you would be hard pressed to ever find on a card.

For many people, this feels exciting and they want to go for it, but also overwhelming and scary to imagine holding multiple cards. I hear this question and remember asking the same thing:

“What about my credit?!! Won’t opening new cards lower my score?”

And the answer may surprise you! Opening new cards should ultimately raise your credit score significantly if handled responsibly.

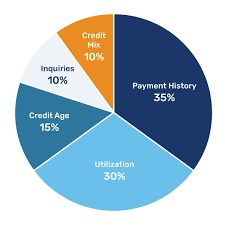

Here’s the breakdown of how a credit score is calculated:

Payment history: paying on time will raise your score significantly since it’s 35% of your total score.

Credit mix: mortgage? Car loan? Credit cards? Having multiple types of credit is seen as making you a less risky borrower.

Credit age: length you’ve had credit. This is why being added as an authorized user to my parents’ cards really helped my credit! Without that, my credit age would be significantly lower.

Inquiries: When the bank pulls your credit report to decide whether or not to approve you. This is part of your credit score people talk a lot about — but remember it’s only 10% of your score yet gets all the attention!

Utilization: How much credit is available to you vs. how much you use. A little known part of the overall score but comprises 30% of it! Second only to paying on time which we all know is immensely important.

Read that last bullet point again!

When you open a new card, there may be a hard pull which will temporarily lower your score slightly. Then, once your card is approved, the credit limit adds on to the existing credit limits you already have, and typically lowers your utilization (assuming you continue to spend around the same amount each month). This is a good thing!

For example:

Scenario 1:

You have one credit card with a limit of $20k.

You spend $5k/month on the card.

Your credit utilization is 25% (actually pretty high!)

Scenario 2:

You open a second card which has a limit of another $20k.

You spend $5k/month over both your cards total (just as before)

Your credit utilization is now about 12% (getting better).

The ideal utilization rate is under 10%! So, this is why folks who have multiple cards, often have the highest credit scores.

And a note that an important part of a points strategy is to be strategic about which cards you hold. There is a lot of marketing out there and a lot of the offers are not good, or can lock you out of better point earning opportunities — and you wouldn’t know it!

That’s why I offer a free Wallet Edit to cut through the noise and make recommendations tailored to your individual needs. I consider all of the banks’ rules and the offers out there to make sure you’re opening a card that’s right for you.

Schedule a free call here to discuss or fill out this form here and I’ll recommend the best card for you today.

So, now you know that opening a new card or holding multiple cards will likely not destroy your credit as your parents probably told you 😬 File it away with old fashioned advice like how you shouldn’t swim after eating and going outside with wet hair will give you pneumonia!

The more you know! 💫

Happy Saturday! Reach out with any thoughts or questions anytime 🖤

And if you are getting value out of this newsletter, please consider becoming a paid subscriber. There are so many tips and tricks I’m sharing with paid subscribers that you’re missing out on if you’re not on that list! And the paid subscribers help make this entire substack possible.

I love writing but it takes a lot of time. Pledging your support will make all the difference. Thanks for considering!